Our approach

Who we serve

Real Estate Developers, Builders, Syndicators, Operators, and Owners.

What we do

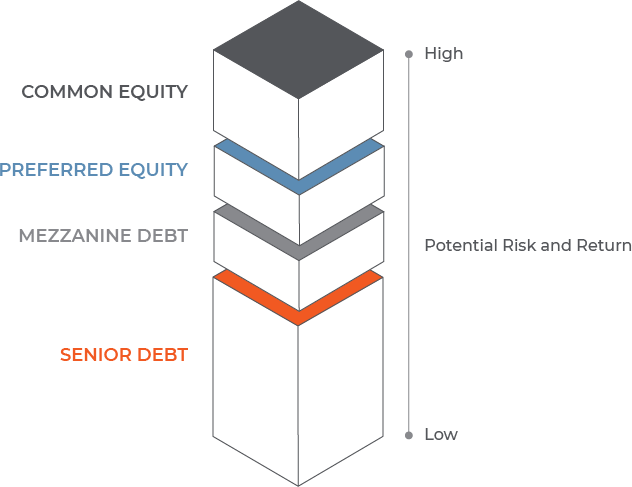

We provide the commercial real estate investor customized capital solutions to maximize the yield, perform detailed analysis to identify risk issues and craft risk mitigation strategies.

How we do it

- In-depth interviews with our clients to understand their real estate expectations.

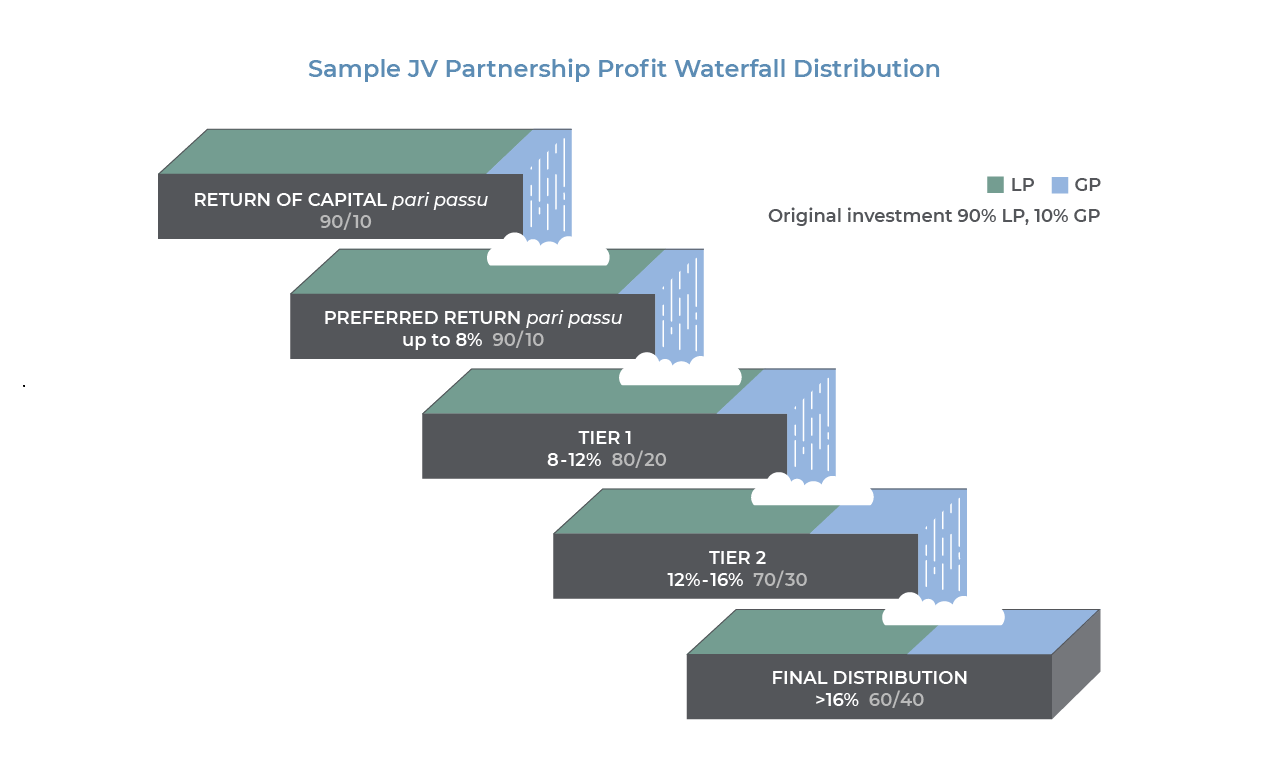

- Prepare a detailed financial model and capital plan and analyses of capital structure options.

- Leverage vetted capital provider relationships to minimize the possible re-trades from credit decisions.

- Collaborate with borrower’s counsel to negotiate favorable financial covenants.

Why should you hire us?

- Access undiscovered capital providers. Commercial real estate debt and equity is complex and access to the right capital providers on a timely basis is not always straight forward.

- Structure a forward-thinking capital strategy from acquisition to planned disposition to meet the business strategy.

- Create a competitive market place to optimize the capital request. We represent the client to access the capital market. Capital providers understand the client is serious to secure the debt or equity request and will provide the best possible proposal to win the assignment.

- Minimize the re-trading from capital providers. While no one can predict the outcome of the credit decisions, we minimize the risks by providing a detailed pre-underwriting debt or equity request to reputable capital providers.